This text version of the agreement is in response to members asking for online access to their agreement without downloading a PDF version. Given the nature of this document, formatting options are limited and minimal.

Changes are indicated in RED.

COLLECTIVE BARGAINING AGREEMENT

between:

VITERRA CANADA INC.

(hereinafter referred to as the “Company”)

and

GRAIN AND GENERAL SERVICES UNION (ILWU • Canada)

(hereinafter referred to as the “Union”)

Covering

GSU Local 2 (Viterra – Regina Office)

As set out in the Certification Order of the Canada Industrial Relations Board

(Board Order No. # 9956-U) dated April 6, 2011

Effective November 1, 2022 – October 31, 2026

Errors and omissions excepted

TABLE OF CONTENTS

ARTICLE 1 – SCOPE & DEFINITION.. 4

ARTICLE 2 – SPIRIT & INTENT. 5

ARTICLE 3 – MANAGEMENT RIGHTS.. 6

ARTICLE 4 – COMPANY RELATIONS.. 6

ARTICLE 5 – MAINTENANCE OF MEMBERSHIP.. 7

ARTICLE 7 – ARBITRATION BOARD.. 10

ARTICLE 8 – BENEFIT PLANS.. 10

ARTICLE 10 – HEALTH & SAFETY.. 13

ARTICLE 11 – WORKERS’ COMPENSATION.. 13

ARTICLE 13 – LEAVES OF ABSENCE.. 16

ARTICLE 14 – SUPPLEMENTAL EMPLOYMENT BENEFIT (SEB) 19

ARTICLE 15 – PROBATION & TERMINATION OF EMPLOYMENT. 21

ARTICLE 16 – DEMOTION FORMULA.. 21

ARTICLE 17 – TEMPORARY PERFORMANCE OF HIGHER DUTY (TPHD) 22

ARTICLE 18 – HOURS OF WORK AND OVERTIME. 22

ARTICLE 19 – SHIFT DIFFERENTIAL, CALL OUT AND STANDBY PAY.. 24

ARTICLE 20 – ABSENCE FROM DUTY.. 25

ARTICLE 22 – GENERAL HOLIDAYS.. 26

ARTICLE 23 – TRADES TRAINING LEAVE OF ABSENCE AND ALLOWANCE.. 27

ARTICLE 24 – POSITION ELIMINATION.. 28

ARTICLE 25 – SCALE OF WAGES/SALARIES, JOB TITLES, SALARY GRADES AND SALARY RANGES 30

ARTICLE 26 – PART-TIME EMPLOYEES.. 31

ARTICLE 27 – EFFECTIVE DATE AND DURATION OF AGREEMENT. 31

ARTICLE 1 – SCOPE & DEFINITION

Viterra Canada Inc. (hereinafter referred to as the “Company”) recognizes the Grain and General Services Union (ILWU • Canada) (hereinafter referred to as the “Union”) for the duration of this Agreement as the sole collective bargaining agent for purposes of collective bargaining in respect of wages/salaries and other conditions of employment on behalf of employees of the Company in the Company’s Regina Office as set out in the Certification Order of the Canada Industrial Relations Board dated April 6, 2011 (which is Board Order No. # 9956-U) and as this Order may be amended from time to time.

DEFINITIONS:

1.1 Regular Full-Time employee – Regular full-time employee shall mean an employee employed to meet ongoing operational requirements on a year-round basis and is scheduled to work the full-time hours contained in Article 18. Regular full-time employees who are laid off shall retain their regular full-time status with the Company while on layoff.

1.2 Regular Part-Time employee – Regular part-time employee shall mean an employee hired to work on a partial day or partial week basis generally consisting of fewer hours than defined in the Regular or Modified Work Schedule in Article 18.

1.3 Temporary employee – Temporary employee shall mean an employee employed to meet seasonal or temporary operating needs. The only provisions of this Agreement applying to the employment of temporary employees are contained in Schedule B.

1.4 Casual employee – Casual employee shall mean an individual who is hired on a job contract or on an hourly basis for unscheduled or irregular work. The only provisions of this Agreement applying to the employment of casual employees are contained in Schedule B.

1.5 Seniority – Seniority commences at date of hire with the Company and is only interrupted in accordance with Article 12.14. In the event of a common seniority date occurring in any competition, the tie will be broken based on years of experience with relevant agricultural companies. In the event that the tie is not broken by applying the foregoing, the tie will be broken based on the reverse alphabet of the last name. A Board of Arbitration referred to in Article 7 hereof or such other appropriate authority shall have the power to reinstate service forfeited due to termination of employment.

For purposes of calculating seniority, the “Company” includes all service earned with any predecessor company acquired or incorporated into Viterra Canada Inc.

1.6 Promotion – shall mean the movement of an employee from a position to a position with a higher salary range.

1.7 Demotion – shall mean the movement of an employee from a position to a position with a lower salary range.

1.8 Transfer – shall mean the movement of an employee from a position to another position with an identical salary range.

1.9 Salary Grade – shall mean the level into which positions of the same or similar value are grouped for compensation purposes.

1.10 Salary Range – refers to the range of salaries to be paid to employees performing a particular job. Each salary range has a minimum, market zone, and maximum wage/salary.

1.11 Market Zone – represents the competitive value for jobs in the market where we operate.

1.12 Work Stream – refers to a group of jobs with the same nature of work.

The spirit and intention of this Agreement is to maintain good and amicable relations between the Company and all of its employees covered by this Agreement, so that the solution of all matters pertaining to conditions of employment may be arrived at by consultation and agreement between the parties hereto, and this Agreement is in no sense to be taken as a discouragement to direct negotiations where a solution can be reached by such means without having recourse to the bargaining procedure hereinafter provided.

3.1 The Union recognizes that the Company has sole authority to manage its affairs, to direct its working forces, including the right to hire, classify, reclassify, determine wages/salaries of employees within the terms of Schedule A hereinafter referred to, to transfer, promote, demote, and to suspend or discharge any employee for just cause, and to increase or decrease the working force of the Company, to re-organize, close, disband any part of the operations or business as circumstances and necessity may require, subject to the right of any employee concerned to lodge a grievance in the manner and to the extent hereinafter provided.

3.2 The Union further recognizes the right of the Company to operate and manage its business in all respects in accordance with its commitments and responsibilities, and to make and alter from time to time, the rules, regulations and policies to be observed by the employees, not inconsistent with the terms of this Agreement.

4.1 It is understood and agreed, inasmuch as the Company recognizes the Union as the employees’ bargaining agency, as evidence of good faith, the Union assumes responsibility for its members in their relations with the Company and will use its best efforts to have the employees’ responsibility under the contract carried out in letter and spirit and to have its members deliver a fair day’s work as called for by the position involved and the reasonable orders of the Company.

4.2 The Company shall provide bulletin boards in the Regina office for official and legitimate union use.

4.3 The Company shall provide all employees with access to copies of appraisals and evaluations. Further, employees shall be given access to their personnel file, upon request, and/or give a union representative permission to access their file.

4.4 The Company will not discriminate in its hiring and employment practices against persons by reason of race, national or ethnic origin, colour, religion, age, sex, sexual orientation, gender identity or expression, marital status, family status, genetic characteristics, physical or mental disability, conviction for which a pardon has been granted, political affiliation and union activity.

4.5 The Union will not discriminate in its practices against persons by reason of race, national or ethnic origin, colour, religion, age, sex, sexual orientation, gender identity or expression, marital status, family status, genetic characteristics, physical or mental disability, conviction for which a pardon has been granted, political affiliation and union activity.

4.6 The Company and the Union are committed to the creation of a workplace free of discrimination and the promotion of equality of opportunity for all employees. As such, the parties agree to work together to identify and remove barriers to the full participation of members of the four designated groups as defined by the Employment Equity Act: women, people with disabilities, Aboriginal peoples, and visible minorities.

ARTICLE 5 – MAINTENANCE OF MEMBERSHIP

5.1 The Company agrees that as a condition of employment, membership dues or sums in lieu will be deducted from the wages/salaries earned by employees in the following categories:

a) All employees for whom the Union has bargaining authority under this collective agreement.

b) All new employees under this collective agreement, as of their first complete pay period following commencement of employment.

5.2 Membership dues or sums in lieu so deducted from salaries shall be paid monthly to the General Secretary of the Union within fifteen (15) calendar days following completion of the last payroll period in the calendar month, remittance to be supported by information with respect to each individual employee, including the period covered by the remittance for that employee.

5.3 The Company shall provide the General Secretary of the Union with a report following each monthly pay period, which shall include the name, location, job title, salary grade, salary, and effective date of all staff changes, including new hires.

6.1 The Company and the Union agree that it is most desirable to resolve misunderstandings and disputes through discussions between the employee and the supervisor, and both the Company and the Union shall encourage employees to discuss their complaints with their supervisors so as to resolve differences quickly and directly without necessarily having to resort to the following formal process.

Employees may have benefit of representation by union officials at any of the steps in the procedure, including in any investigation meetings, and similarly management representatives may have benefit of counsel.

Formal grievances, whether individual or executive, shall be raised within thirty (30) days of the date on which the grievance becomes apparent, or ought to have become apparent. Grievances shall be in writing on the approved grievance form, must identify the specific clauses in the Collective Agreement that are being violated and provide specific details in writing with respect to the individuals whose rights have been violated and/or damages resulting from the breach of the Collective Agreement and shall be dealt with in the following manner without stoppage of work.

6.2 Step 1 – The grievance shall be taken up with the first-line out-of-scope supervisor who shall render a decision within three (3) working days of the receipt of the grievance. Executive grievances (those submitted by the Union organization rather than by an individual), and grievances which involve appointment to a position within the scope of the agreement, or dismissal or a suspension in excess of seven (7) calendar days, shall dispense with step 1.

Step 2 – Within seven (7) working days of the receipt of the decision in step 1 in the case of individual grievances, and within thirty (30) days of the date on which the grievance(s) becomes apparent or ought to have become apparent in the case of executive grievances, the grievance shall be taken up with the appropriate manager who shall render a decision within seven (7) working days.

In grievances, which involve a dismissal, or a suspension which exceeds seven (7) calendar days, the Company and the Union may combine steps two and three of the grievance procedure to expedite the matter.

Step 3 – In the event that a decision is not rendered within seven (7) working days, or the decision does not lead to a resolution of the grievance in the view of the parties, the Union shall immediately consult with the Company. If settlement is not achieved within a further fourteen (14) working days it may be submitted to arbitration as hereinafter provided for.

Step 4 – A grievance is referred to arbitration by either party giving notice to the other in writing of their intention to do so. Such written notice shall be given within ten (10) working days of the receipt of decision at step 3, or from the expiry of the time limits at step 3, whichever is the earlier. Within seven (7) working days of receipt of such written notice, each party shall appoint a nominee. Within a further seven (7) working days the Union and the Company shall consult with regard to appointing a Chairperson to the Board. If the Union and the Company fail to agree on the appointment of a Chairperson, they shall request the Federal Minister of Labour to appoint a Chairperson of the Arbitration Board and the person so appointed shall be duly empowered to act accordingly. Upon agreement between the Company and the Union the Board may consist of a single arbitrator.

6.3 Time limitations in the preceding process may be extended by mutual agreement between the parties, provided that requests for extension are made prior to the expiry of the time limitation.

6.4 In the event of a grievance, the Company agrees, upon request, to provide the Union with copies of disciplinary and/or appraisal documents that have been served upon the employee which the Company intends to use in regard to the specific grievance.

6.5 References to disciplinary matters shall be removed from the employee’s personnel file after two (2) years providing there have been no further incidents of the same or substantially similar nature during that two year period, and such references, once removed, will no longer be admissible as evidence at any arbitration hearing.

6.6 A grievance not initiated or advanced within the time limits shall be deemed abandoned, and all rights or recourse to the grievance and arbitration procedure shall be at an end.

7.1 The Arbitration Board under Article 6 (Step 4) shall not have authority to alter or change any of the provisions of the Agreement, or to insert any new provisions, or to give any decision contrary to the terms and provisions of the Agreement, but it is agreed that where disciplinary action is involved the Arbitration Board shall have the power to award a penalty or amend a penalty imposed by the Company.

7.2 The decision of the Board or a majority of the arbitrators shall be final and binding upon the parties hereto and upon any employee or employees concerned. If there is no decision by a majority of the Board, then the decision of the Chairperson shall be similarly final and binding.

7.3 No costs of any arbitration shall be ordered to or against either party, but each party shall be responsible for the expenses and/or fees payable to its nominee and for one-half the expenses and/or fees payable to the Chairperson of the Board.

8.1 All eligible employees who have completed ninety (90) days service with the Company shall be entitled to participate in the Company’s benefit plans and shall be enrolled on the first of the month following the completion of the ninety (90) day service period.

The Company shall give the Union sixty (60) days calendar notice of any change to the insurers or rearrangement of the benefit plans coverage and shall consult the Union prior to implementing any changes to the benefit plans.

8.2 Sick Leave

In the case of sickness or disability, all employees shall be entitled to benefits as follows, subject to the additional terms and conditions outlined in Appendix A of this agreement:

a) Employees shall earn and accumulate sick leave credits on the basis of one and one-quarter (1¼) days per month of continuous service from commencement of employment, subject to any minimum requirements provided in the Canada Labour Code. Maximum accumulative sick leave credits shall be two hundred and fifty (250) working days.

b) Employees who are entitled to payment of wages/salaries during sick leave shall be paid at the rate of pay that would apply if the employee were not absent on sick leave to the limit of his/her accumulated sick leave credits and to a maximum of one hundred and nineteen (119) calendar days in any one illness.

c) All sick leave usage under this Plan shall be deducted from accumulated sick leave credits.

d) When sick leave allowance payments have expired, an employee may be granted leave of absence without pay as provided for in Article 13.

e) All recipients of sickness and disability allowance payments must provide on request of the Company or its designate, medical reports of their condition, subject to any limitations in the Canada Labour Code.

f) An employee on sick leave shall only accumulate vacation credits for the first two (2) months of sick leave.

g) Sickness and disability allowance payments under this Plan will not apply to any employees receiving compensation under The Workers’ Compensation Act, 2013.

h) Employees are eligible to use sick leave for non-occupational illness or injury, medical appointments, organ or tissue donation and quarantine. “Medical appointments” includes appointments with a doctor or dentist, or another health care practitioner seen for the purposes of diagnosis or treatment of an illness or injury.

8.3 Extended Sick Leave

In the case of total disability, employees are eligible to apply for sick leave and extended sick leave benefits as follows, subject to the additional terms and conditions outlined in Appendix A of this agreement:

a) Employees shall be eligible to apply for extended sick leave benefits so as to provide benefits in the amount of 66⅔% of their regular earnings, for:

(i) the period of absence due to sickness in excess of one calendar week; or

(ii) the period of absence following the expiration of the employee’s sick leave credits in Article 8.2, in circumstances where the use of sick leave credits in Article 8.2 exceeds one calendar week.

b) Maximum benefit payable in any one illness shall be for sixteen (16) weeks or for one hundred and twelve (112) calendar days.

c) Benefits under this plan shall be reinstated immediately on return of an employee to work following an illness.

d) The regular rate of pay, which an employee is receiving at time of illness, shall be used in determining benefits under this Plan.

e) All recipients of benefits under this Plan must provide, on request of the Company or its designate, medical reports on their condition.

f) An employee on sick and/or extended sick leave shall only accumulate vacation credits for the first two (2) months of sick leave.

g) Benefits under this Plan shall not apply to any employee receiving compensation under The Workers’ Compensation Act.

9.1 All Regular Full-Time and Regular Part-Time employees shall, as a condition of employment, participate in a defined contribution pension plan maintained by the Company. These eligible employees shall be enrolled in the plan on the first day of the month following completion of ninety (90) day service period.

Participating employees will each contribute five percent (5%) of earnings to the plan. The Company will contribute six percent (6%) of an employees earnings to the plan.

“Earnings” as used in this clause shall mean the regular remuneration paid by the Company, excluding overtime, shift differential, pay in lieu of vacation and bonus or incentive pay.

10.1 The Company and the Union recognize an employee’s right to working conditions which show respect for his/her health, safety, and physical well being.

10.2 The parties recognize that the maintenance and development of the employees’ general well-being constitute a common objective. Consequently, all efforts shall be deployed to prevent and correct any situation and any conduct liable to compromise the health and safety of employees or deteriorate the work environment, including but not limited to fatigue, limited rest periods and irregular work shifts.

10.3 The Company and the Union recognize the need for constructive and meaningful consultations on health and safety matters. To this end, joint safety committees shall be maintained.

10.4 Boot Allowance – It shall be a condition of employment that appropriate safety footwear be worn where designated by the Company. Regular employees at these worksites who are required to wear safety footwear shall be provided with a payment on an annual basis. The value of the payment shall be two hundred and twenty-five dollars ($225.00) per year. Employees will be provided with a voucher on an annual basis upon request. Alternatively, the employee may seek reimbursement for their purchase of safety footwear (up to $225.00 per year) by submitting proof of purchase and following the Company’s prescribed processes for an expense claim.

ARTICLE 11 – WORKERS’ COMPENSATION

11.1 In all cases of temporary total disability, as defined by the Worker’s Compensation Board in its administration of The Workers’ Compensation Act, 2013, sustained by an employee as a result of an occupational injury covered by the Act, the Company agrees to continue to pay the employee an amount equal to his/her net earnings (after income tax) prior to injury during the period of such disability and salary increases in accordance with Schedule A whilst he/she is receiving full compensation from the Workers’ Compensation Board and retain the compensation received from the Board.

11.2 An employee on Workers’ Compensation shall only accumulate vacation credits for the first two (2) months.

11.3 The Company and the Union agree it is in the best interests of employees to return to work as soon as reasonably possible following compensable illness or injury. Employees will be offered and are expected to participate in a return to work plan when appropriate to do so. The return to work plan will be designed in conjunction with the employee, the manager, the employee’s physician and a union representative if requested by the employee. The employee will continue to receive benefits of the Article during the return to work plan.

Vacancies

12.1 When the Company determines it necessary to fill a vacant position within the scope of this Agreement, the position shall be posted. Vacancies will be open to applicants for ten (10) days. It will be the policy of the Company that in filling posted positions, employees of the Company shall be given first consideration.

12.2 Notices of such vacancies shall be available online and will be provided to the Union office.

12.3 Notices of vacancies will contain information pertinent to the position being posted such as wage/salary and location.

12.4 The Company, in its sole discretion, may elect to fill a vacant position by transfer. The Union may make representation to the Company where the circumstances of the transfer warrant such representation.

12.5 When filling vacancies, ability, qualifications and merit as determined by the Company shall be the governing factors.

Layoffs

12.6 In the event of a layoff, the Company shall, generally on a location basis, retain the employees who, based on ability, qualifications and merit as determined by the Company are best suited for the positions and in the event two or more candidates are relatively equal, the Company will retain the employee with the greater seniority. Recall from layoff will be done on the same basis.

12.7 The Company shall provide fourteen (14) calendar days written notice of layoff or pay in lieu of such notice or any combination thereof.

12.8 An employee who is laid off shall endeavor to obtain an alternate position by bidding on vacancies in accordance with Article 12.5. Bumping shall not be permitted.

12.9 An employee who obtains an alternative position in accordance with Article 12.8 shall have his/her wage/salary maintained in accordance with Article 16.

12.10 The Company will continue benefit plans while on layoff provided the employee pays the employee contribution to the plan.

Recall

12.11 In the event that an employee is recalled to work while on layoff, the date of layoff will remain until such time as an employee works a minimum of forty (40) consecutive regular hours after the recall.

12.12 Regular employees on layoff will maintain their official employment start date and have recall rights for twelve (12) months after which their employment will be deemed to be terminated and they will receive a Company paid severance allowance calculated on the basis of two (2) week’s pay per year of service, prorated for partial years and part-time service.

12.13 When an employee is to be recalled to work, the Company will attempt to contact the employee by telephone. If telephone contact is not made then a recall notice will be sent by registered mail to the employee’s last known address. If the employee does not respond in person or by telephone or email to the appropriate Manager within seven (7) calendar days of the recall notice being mailed, the employee will lose his/her recall rights and employment will terminate.

12.14 An employee shall lose his/her seniority if he/she:

a) Retires;

b) Resigns;

c) Is terminated in accordance with Articles 12.12 and/or 12.13;

d) Is dismissed for just cause; or

e) Fails to report for three (3) consecutive shifts except for circumstances beyond the employee’s control, in which case the employee’s employment will be terminated. Nothing in this clause shall restrict the right of the Company to dismiss an employee who is “AWOL,” meaning, absent without authorization.

ARTICLE 13 – LEAVES OF ABSENCE

13.1 General Leave of Absence

a) Leave of absence without pay may be granted to employees for valid reasons as set out by Company policy.

b) An employee on general leave of absence shall not accumulate sick leave credits beyond the minimum required by the Canada Labour Code. The accrual will cease when the carry forward and accrual for the current calendar year reach 10 sick days. Sick leave accrued can only be used once an employee returns from this general leave of absence. An employee on general leave does not or earn vacation credits, but shall retain the seniority, sick leave credits, and vacation credits earned prior to commencing leave of absence.

c) Employees do not have the option of continuing their benefit coverage during the leave.

d) Employees on leave of absence shall be required to apply for any extension.

13.2 Maternity/Adoption/Parental Leave

a) In accordance with the Canada Labour Code an employee shall be granted maternity, adoption, and/or parental leave of absence without pay.

b) Employees on maternity, adoption, and/or parental leave shall only accumulate vacation credits for the first two (2) months of the leave.

c) Employees on maternity, adoption and/or parental leave shall only accumulate the minimum number of sick leave credits that are required by the Canada Labour Code. The accrual will cease when the carry forward and accrual for the current calendar year reach 10 sick days. Sick leave accrued can only be used once an employee returns from this leave of absence.

d) Employees on Maternity/Adoption/Parental Leave shall be entitled to participate in Viterra’s Maternity/Adoption/Parental Leave – Top Up Plan. The Company shall give the Union sixty (60) days notice of any changes to the Top Up Plan and shall consult the Union prior to implementing any changes.

13.3 Pressing Necessity Leave

Leave of absence with pay shall be granted for the purpose of attending to an emergent situation which is unforeseen and requires their immediate attention, for any circumstances not covered by Personal Family Leave in Article 13.9. Pressing necessity leave is to be utilized for a maximum of one (1) day per occurrence. Further time off by the employee to attend to the situation is considered at their discretion and will be taken as vacation, time in lieu, General Leave of Absence, or any applicable leave as directed by policy.

13.4 Bereavement Leave

Leave of absence up to ten (10) days, the first three (3) of which shall be with pay, shall be granted to employees for the purpose of arranging or attending the funeral of members of his/her immediate family. Where major travel or special circumstances are involved, approval may be given to extend the three day limit to five (5) days. Immediate family shall be defined to include only the employee’s mother, father, mother-in law, father-in-law, stepparents, spouse (including common-law relationships), daughter, son, sister, brother, sister-in-law, brother-in-law, daughter-in-law, son-in-law, aunt, uncle, grandmother, grandfather, grandchild, and spouse’s grandparents, or equivalent relationship. In the event an employee is on compassionate care leave or leave related to critical illness, and the family member the employee is caring for dies, the employee is then entitled to take bereavement leave. The employee can take Bereavement Leave in one or two periods starting on the day on which the death occurs and ending 6 weeks after the date of the funeral, burial, or memorial service of that immediate family member.

13.5 Serious Illness Leave

In the event an employee’s presence is required to attend to a spouse’s, parent’s, or child’s serious illness, injury or physical or mental condition that requires medical care, leave of absence with pay up to three (3) days will be granted. Eligible time includes time to be with the family member while they are undergoing medical treatment in a medical facility and/or time to attend to the family member at home after such treatment. Where major travel or special circumstances are involved, approval may be given to extend the three (3) day limit to five (5) days. Use will be monitored and may be withheld at the discretion of the Company if excessive.

13.6 Jury Leave

In keeping with the policy that an employee not suffer a loss of pay while serving as a juror, the remuneration to be received by the employee on any working day the employee reports for or serves on jury duty shall be regular rate of pay for the day less jury duty fees receivable for that day.

13.7 Union Leave

a) The Company shall provide leave of absence with pay for three (3) bargaining unit employees to a maximum of eight (8) days each for attending negotiations.

b) Subject to operational requirements, additional leave shall be granted as requested by the Union. No employee shall experience any loss or interruption in pay, benefits, service or seniority while on such a leave. The Company shall bill the Union for the cost of such additional leave within thirty (30) calendar days of its occurrence.

c) Subject to operational requirements, leaves of absence shall also be granted to elected officers and delegates to attend to the business of the Union. No elected officer or delegate shall suffer any loss or interruption of pay, benefits, service or seniority while on such a leave. The Company shall bill the Union for the cost of such additional leave within thirty (30) calendar days of its occurrence.

d) No employee representative appointed or elected by the Union’s members for the purpose of attending grievance or disciplinary meetings or other meetings provided for under this agreement shall suffer any loss or interruption of pay, benefits, service or seniority while attending such meetings.

13.8 Military Leave

Employees who have completed six (6) consecutive months of continuous service with the Company shall be entitled to a leave of absence without pay and without benefits for up to three (3) weeks per year for the purpose of serving as a member of her Majesty’s Canadian Armed Forces. Leaves beyond three (3) weeks in any year may be granted at the discretion of the Company. Upon return from Military Leave, the employee shall be placed in the same or similar position with the same rate of pay as they occupied prior to the leave. Employees do not have the option of continuing their benefit coverage during the leave.

13.9 Personal Family Leave

a) Each year, employees shall be allowed to take up to five (5) days of Personal Family Leave, the first three (3) days of leave that is used shall be with pay.

b) This leave shall be used only for the purposes of carrying out responsibilities related to the health, care or education of a family member, or addressing any urgent matter concerning themselves or their family members.

c) If requested by the Company, the employee shall provide documentation to support the reasons for the leave, provided it is reasonably practicable for the employee to obtain and provide that documentation.

ARTICLE 14 – SUPPLEMENTAL EMPLOYMENT BENEFIT (SEB)

14.1 During the term of the Collective Agreement, employees who are laid off work shall receive a Supplemental Employment Benefit allowance from the Company, which altogether with Employment Insurance benefits shall equal seventy-five percent (75%) of the employee’s normal weekly earnings, less overtime and other premium payments.

The terms governing payment of the SEB shall conform to the requirements of the Canada Employment Insurance Commission (C.E.I.C.) and shall include the following provisions:

a) An employee who has completed one year of service with the Company at date of layoff will qualify for SEB benefits.

b) SEB benefits will be payable only to those employees on layoff who are eligible for and where applicable, have received Employment Insurance benefits in each week of layoff. A week of layoff shall mean a period of seven (7) consecutive days commencing on and including Sunday.

c) An employee must apply to the Company and provide the necessary proof of eligibility for SEB in a manner acceptable to the Company.

d) An employee shall not be entitled to SEB after:

i) He/she has refused a call back to work in accordance with the provisions of the Collective Agreement; or

ii) He/she is receiving sickness and accident indemnity payments under the Company plan, Workers’ Compensation or severance pay in any week of layoff.

e) The benefit level paid under this plan is set at seventy-five percent (75%) of the employee’s normal weekly It is understood that in any one week the total amount of SEB, Employment insurance gross benefits and any other earnings received by the employees will not exceed ninety-five percent (95%) of the employee’s normal weekly earnings.

f) No employee shall be paid SEB for more than twenty-six (26) weeks in a fifty-two (52) week period.

g) The payment of benefits to employees on layoff will be made by the Company on a “pay-as-you-go” basis separate from the regular payroll.

h) Employees who are laid off shall have the right to defer receipt of vacation pay until a time subsequent to recall to work. This does not imply they have right to take vacation time after they return to work.

i) Service Canada will be advised in writing of any change to the plan within thirty (30) days of the effective date of the change. Payments of guaranteed annual remuneration, deferred remuneration, or severance pay will not be reduced or increased by payments received under the SEB plan.

ARTICLE 15 – PROBATION & TERMINATION OF EMPLOYMENT

15.1 A newly hired employee shall be on probation for the employee’s first ninety (90) days worked. The probationary period may be extended by agreement between the Union and the Company.

Notwithstanding the generality of the foregoing, a newly hired employee in an Information Technology position in salary grade 3 and higher shall be on probation for the employee’s first one hundred and eighty (180) working days.

15.2 A probationary employee may grieve a dismissal but the answer provided at step 3 of Article 6 shall be final and binding upon the parties hereto and upon any employee concerned.

16.1 When an employee is involuntarily demoted and/or, their position is eliminated and they bid on and accept a demotion, the following shall apply:

a) The employee shall continue to receive the wage/salary being received prior to demotion for a period not to exceed eleven (11) months.

b) Upon commencement of the twelfth (12th) month, the employee’s wage/salary shall be reduced to an appropriate rate within the range of the new position.

ARTICLE 17 – TEMPORARY PERFORMANCE OF HIGHER DUTY (TPHD)

17.1 An employee assigned to temporarily relieve in a position with a higher salary grade shall be paid as if he/she had been promoted to same. The employee must be required to perform the majority of the duties of the higher position.

17.2 There shall be a three (3) consecutive day waiting period for each occurrence. When an employee has worked three (3) or more consecutive days in the higher paid position they shall be paid at the higher rate for all time worked in the position.

17.3 After ninety (90) days of relief assignment, if the position is still vacant or the incumbent has not returned, it shall be posted as a temporary position unless otherwise agreed to by the Company and the Union. Selection shall be subject to Article 12 – Seniority.

17.4 Experience obtained by an employee during temporary performance of higher duty shall not qualify the employee for promotion to a vacancy unless the temporary vacancy has been posted.

ARTICLE 18 – HOURS OF WORK AND OVERTIME

18.1 Hours of Work

The Company retains the right to schedule hours of work of employees as is necessary to ensure efficient operations and to provide coverage for the determined hours of operation.

18.2 Regular Work Schedules and Modified Work Week Schedules

Regular work schedules for employees shall be defined as five (5) days per week consisting of seven and a half (7½) hours per day and thirty-seven and a half hours (37½) hours per week.

The Company may implement modified work schedules or schedules with variable hours of work per day provided the Union is notified and a majority of the affected employees agree to such schedule. The Company will provide a minimum of twenty-one (21) calendar days’ notice of the implementation, modification or cancellation of modified work schedules.

Subject to section 18.5 below, the typical workweek shall consist of thirty-seven and a half (37½) hours of work paid at the employee’s straight hourly rate and the work day shall normally consist of seven and a half (7½) hours work paid at the straight time hourly rate.

18.3 Scheduled Days of Rest

As a norm, employees shall be entitled to two (2) consecutive days of rest each week except where schedule changes or shift rotation occur resulting in one (1) day of rest at the time of the change.

18.4 Overtime

Overtime for full-time employees is defined as time worked in excess of an employee’s regularly scheduled hours of work.

1) Overtime at the rate of one and one-half (1.5) times the employee’s regular rate of pay shall be paid on the following basis:

a. For the first four (4) hours of work in excess of the employee’s regularly scheduled shift on a scheduled day of work; and

b. For the first eleven and a half (11.5) hours on a day of rest.

2) Overtime at the rate of two (2) times the employee’s regular rate of pay shall be paid on the following basis:

a. For all hours in excess of those worked in 1) a. above on a scheduled day of work; and

b. For all hours worked in excess eleven and a half (11.5) hours on a day of rest.

Employees shall be paid for all overtime worked at the appropriate overtime rate of pay as described in this Article. However, with the agreement of the Company, employees may bank their overtime worked, at the appropriate overtime rate, to be taken as paid time off work.

18.5 Maximum and Minimum

The hours of work as stated in this Article are not to be construed as a guaranteed minimum of hours to be worked, however, when an employee’s regularly scheduled hours of work for the week are reduced by the Company, the employee will be paid as if they had worked the regular hours scheduled.

ARTICLE 19 – SHIFT DIFFERENTIAL, CALL OUT AND STANDBY PAY

19.1 Shift Differential

A shift differential of one dollar and seventy-five cents ($1.75) per hour shall be paid on all hours worked between 1800 hours and 0600 hours.

19.2 Weekend Differential

A weekend differential of one dollar and seventy-five cents ($1.75) per hour shall be paid on all hours worked between 00:01 on Saturday to 24:00 on Sunday.

19.3 Call-Out Guarantee

A minimum of four (4) hours pay will be paid to an employee who is called out for duty by management after the employee has left the Company premises. The Company and the employee may agree to a lesser amount for less than four (4) hours worked.

19.4 Standby Pay

Standby duty shall mean any period of not more than eight (8) hours during which time an employee is not on regular duty but has been assigned standby duty and must be available to respond to any request to return to duty. This shall include, but not be limited to, those employees scheduled to be on call the manager or supervisor and assigned to carry a pager, cellular phone, or laptop computer as a result of the standby duty assignment.

Employees who are assigned to standby shall be paid a standby premium calculated at the rate of one and one half (1.5) hours of regular pay for each period of assigned standby. With the agreement of the Company, employees may bank standby pay in a time-in-lieu bank as one and one half (1.5) regular hours per period of standby.

19.5 There shall only be one premium paid per hour worked. In a case where more than one premium applies, the employee shall receive the highest premium.

ARTICLE 20 – ABSENCE FROM DUTY

20.1 No employee shall absent himself/herself from the Company’s premises during their scheduled hours of work except with the consent of supervisory personnel.

21.1 Vacation is to be taken at times mutually agreed upon between the Company and the employee. Vacation will be paid at an employee’s regular rate of pay.

21.2 Vacation Entitlement

a) Employees who have not completed at least six (6) years of service shall earn vacation at the rate of three (3) weeks per each full year of service.

b) Employees who have completed six (6) years of service shall in the years of service subsequent to the sixth (6th) anniversary date of employment earn vacation at the rate of four (4) weeks per year.

c) Employees who have completed fourteen (14) years of service shall in the years of service subsequent to the fourteenth (14th) anniversary date of employment earn vacation at the rate of five (5) weeks per year.

d) Any employee who was earning six (6) weeks of vacation per year as of February 1, 2008 will continue to earn six (6) weeks of vacation per year.

21.3 Vacation Pay on Overtime Worked

In addition to the above Vacation Entitlement, employees will earn vacation pay on overtime worked at the same rate as their vacation accrual rate up to a maximum of ten percent (10%).

21.4 Payout of Vacation Accrued upon Termination of Employment

In the case of termination of employment, the Company shall pay to the employee any vacation pay owing to him/her in respect of any prior completed year of employment plus the vacation pay owing to him/her for the current year.

If an employee’s vacation is in a negative balance at the date of termination they will be required to repay amounts owing.

21.5 When vacation pay is paid out rather than being taken as vacation, the payout shall be based on the employee’s accrual rate at their rate of pay at the time of payout.

22.1 The following shall be recognized as statutory holidays with pay at regular straight time hourly rates:

New Year’s Day

Family Day

Good Friday

Victoria Day

Canada Day

Saskatchewan Day

Labour Day

National Day for Truth and Reconciliation

Thanksgiving Day

Remembrance Day

Christmas Day

Boxing Day

22.2 In addition to pay for the holiday, an employee required to work on the statutory holiday will be paid not less than one and one-half times his/her regular hourly rate of pay for all hours worked on that day.

22.3 General/Statutory Pay for Modified Work Week Schedules

Employees working a Modified Work Week Shift Schedule or whose work is averaged over multiple weeks as described in Article 18.5 shall receive seven and a half (7½) hours pay at their regular rate in addition to overtime at the rate of one and a half times (1½ X) their regular rate of pay for all hours worked on a general holiday. Such employees, who do not work on a general holiday, will receive seven and a half (7½) hours pay at their regular rate of pay.

ARTICLE 23 – TRADES TRAINING LEAVE OF ABSENCE AND ALLOWANCE

23.1 Subject to successful registration of this plan with Service Canada, the Company agrees to pay employees who are on a leave of absence to attend trades training a Supplemental Employment Benefit (SEB) allowance. The SEB allowance, together with Employment Insurance benefits received, shall equal ninety-five percent (95%) of the employee’s normal weekly earnings, less overtime and other premium payments.

Payment will be made only for those apprenticeships and/or training arrangements approved by the Company. The Company shall determine the required amount of trade certified employees based on business/service demands.

The terms governing payment of the SEB shall conform to the requirements of the Canada Employment Insurance Commission (C.E.I.C.) and include the following provisions:

a) SEB benefits will be payable only to those employees who are eligible for and are in receipt of Employment Insurance benefits in each week of leave. A week of leave shall mean a period of seven (7) consecutive days commencing on and including Sunday.

b) An employee must apply to the Company and provide the necessary proof of eligibility for SEB in a manner acceptable to the Company. Approval shall be at the sole discretion of the Company.

c) The benefit level paid under this plan is set at ninety-five percent (95%) of the employee’s normal weekly earnings. It is understood that in any one week the total amount of SEB, Employment insurance gross benefits and any other earnings received by the employee will not exceed ninety-five percent (95%) of the employee’s normal weekly earnings.

d) The payment of top-up to employees on leave will be made by the Company on a “pay-as-you-go” basis separate from the regular payroll.

e) Requests for a leave of absence to attend trades training and requests for the trades training allowance shall be submitted in writing by the employee to appropriate management personnel.

f) In the event an employee has made arrangements for approved course attendance and a layoff is invoked the employee will be entitled to benefits under this provision subject to the conditions referred to above.

g) An employee shall not be entitled to SEB if he/she is receiving sickness and accident indemnity payments under the Company plan or Workers’ Compensation.

h) Employees who receive payments under these provisions and do not successfully complete that session’s trades training shall be required to repay the Company through regular payroll deductions over the six (6) months following their return to work.

i) Employees who receive payments under these provisions and leave the Company on their own accord shall be required to pay the Company an amount equal to their training allowance less $2,500 for each six months of employment since the training.

j) Service Canada will be advised in writing of any change to the plan within thirty (30) days of the effective date of the change. Payments of guaranteed annual remuneration, deferred remuneration, or severance pay will not be reduced or increased by payments received under the SEB plan.

ARTICLE 24 – POSITION ELIMINATION

24.1 In the event the Company plans to eliminate positions, the Company shall give the Union and the affected employees a minimum of one-hundred and twenty (120) calendar days notice or pay in lieu of notice for all or any portion thereof. Any pay in lieu of notice will be paid in the form of a lump sum payment which includes the Company’s portion of pension contributions and benefit premiums.

When the notice referred to above indicates that ten percent (10%) or more of the employees are negatively affected, the Company and the Union agree to meet within thirty (30) days to review the opportunities and options available to employees notwithstanding that a collective agreement is in place.

For clarity, this article is intended to apply to internal Company reorganizations that result in the elimination of positions and is not applicable in the case of successorship, which shall be administered pursuant to the Canada Labour Code.

24.2 In the event that the Company chooses to provide the employee with pay in lieu of notice for all of the one-hundred and twenty (120) calendar day notice period referred to in Article 24.1, the employee has the option of choosing immediate termination of employment. If the employee chooses this option, the position elimination will be effective immediately and:

a) the employee shall immediately receive severance pay in accordance with Article 24.4; and

b) the employee shall not be entitled to the options in Article 24.6.

24.3 Subject to Article 24.2, position elimination will not become effective until after the notice period is complete.

24.4 An employee who receives notice of position elimination in accordance with this Article shall have the right to receive Company-paid severance pay which shall be two (2) weeks’ pay for each year of service, pro-rated for partial years. For the purpose of severance service shall include all continuous service with the Company

24.5 An employee who receives notice of position elimination may endeavor to obtain an alternate position by bidding on vacancies in accordance with Article 12.

24.6 An employee who receives notice of position elimination in accordance with this Article who does not obtain another permanent position with the Company prior to their employment termination date shall have the right to receive severance pay. Employees shall have the option of:

a) Receiving severance and terminating employment upon completion of the notice period; or

b) Deferring the employment termination date and receipt of severance for six (6) months and receiving Supplemental Employment Benefits (SEB) in accordance with Article 14.

i) This option shall not extend the period of employment for purposes of severance calculation.

ii) Employees who choose this option and accept a permanent position with the Company prior to their employment termination date will not be eligible to receive severance.

24.7 The Company shall notify employees who opt to defer receipt of severance in accordance with Article 24.6 (b) of any vacancies occurring in the bargaining unit subject to the employee ensuring the Company is provided with a current telephone number and mailing address, including an email address.

24.8 Technological change shall be defined as:

a) the introduction of equipment or material of a different nature or kind than that previously utilized by the employer in the operation of the work, undertaking or business; and

b) a change in the manner in which the employer carries on the work, undertaking or business that is directly related to the introduction of that equipment or material.

24.9 This Article is intended to assist employees affected by technological change and accordingly Sections 52, 54, and 55 of the Canada Labour Code with respect to Technological Change do not apply during the term of the Agreement.

24.10 Sections 214 to 229 of the Canada Labour Code with respect to Group Terminations do not apply during the term of the Agreement.

ARTICLE 25 – SCALE OF WAGES/SALARIES, JOB TITLES, SALARY GRADES AND SALARY RANGES

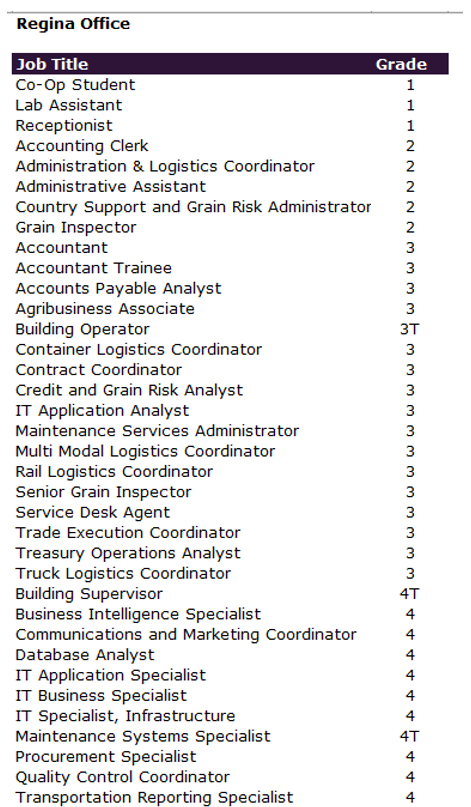

25.1 The Scale of Wages/Salaries, Job Titles, Salary Grades and Salary Ranges for employees covered by this agreement shall be set forth in Schedule A which shall form part of this Agreement.

25.2 The Company shall notify the Union of any new positions being introduced to the bargaining unit and any substantially changed job descriptions. The salary grade for new or revised positions shall be subject to negotiations between the parties and negotiations shall commence respecting the new position within ten (10) calendar days.

25.3 Implementation of Salary Schedule A

The job titles, salary grades and salary/wage ranges in Schedule A shall apply on the effective date as indicated in Schedule A or as otherwise agreed.

ARTICLE 26 – PART-TIME EMPLOYEES

26.1 Seniority for part-time employees will be calculated on the basis of seven and a half (7½) hours of work equaling one day service and shall, on completion of the probationary period, be counted from date of commencement.

26.2 Sick-leave entitlements for part-time employees will be earned on the basis of one and one-quarter (1¼) day’s entitlement (10 hours) for each one hundred and sixty-two and a half (162½) hours worked after achieving part-time status and will be available to the employee to maintain income for any scheduled work lost due to illness or injury.

26.3 Part-time employees will pay Union dues in accordance with the provisions herein.

26.4 Upon completion of ninety (90) working days, a part-time employee working at least fifteen (15) hours per week (averaged over the shift cycle), shall have access to the benefit plans referenced in Article 8 – Benefit Plans.

26.5 Part-time employees will not contribute to the pension plan until completion of ninety (90) days of service and shall be enrolled on the first of the month following the completion of the ninety (90) day service period referenced in Article 9 – Pension Plan.

ARTICLE 27 – EFFECTIVE DATE AND DURATION OF AGREEMENT

This Agreement shall be effective from the 1st day of November, 2022 and shall be valid until the 31st day of October, 2026, and thereafter from year to year unless a written notice is given by either party within the period of four months immediately preceding the date of expiration of the term of the Collective Agreement, of their desire to terminate this Agreement or negotiate a revision thereof, in which case this Agreement shall remain in effect without prejudice to any retroactive clause of a new Agreement until negotiations for revision or amendments hereto have been concluded and a new Agreement superseding this Agreement has been duly executed.

The amendments to the Collective Agreement, unless otherwise agreed, are effective upon the date of ratification by the parties.

FOR Grain and General Services Union

Steve Torgerson

Mason Van Luven

Howard Wilson

Kaylee Kruger

FOR Viterra Canada Inc.

Angela Zborosky

Andrew Bedford

Remi Gaudet

Devon Johnson

Christie Trembicki

Josh Fink

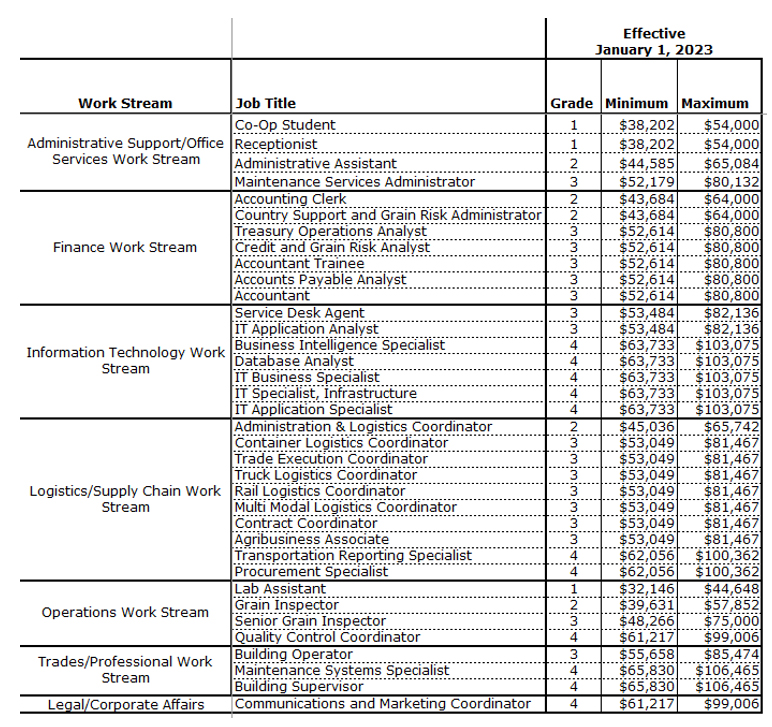

Employees shall be paid in the following salary ranges according to their salary grade and work stream. An employee’s pay level within the range for the employee’s salary grade and work stream will be determined based on the employee’s demonstrated performance.

In the event of job reclassification, employees will be moved into the appropriate salary grade and work stream and be paid in accordance with the corresponding salary range. In cases where employees are being paid a wage/salary below that of the new salary range, they shall be brought up to the minimum of the new salary range. In cases where employees are being paid a wage/salary above that of the new salary range, their salary shall be red circled until such time as their wage/salary is within the salary range, however, they will be provided with a lump sum payment in lieu of their annual wage/salary increase.

The Company reserves the right to implement employee retention programs, share purchase programs, incentive plans and market supplement programs in its sole and absolute discretion.

VITERRA COMPENSATION STRUCTURE – Effective January 1, 2023

(Any required compensation adjustments will be made as part of the merit pay process and effective as of January 1, 2023).

VITERRA COMPENSATION STRUCTURE – Effective January 1, 2024

(Any required compensation adjustments will be made as part of the merit pay process and effective as of January 1, 2024).

Note: The Salary Ranges 1T through 5T (Trades/Professional work stream) are approximately 10% higher than the Salary Ranges for the corresponding Grades 1 to 5. This is a temporary increase intended to meet the demands of recruitment and retention challenges as a result of a shortage of skilled workers in these roles. As a temporary measure, these salary ranges will be reduced to the same level of ranges that apply to the other positions (Grades 1 through 5), excluding those in the Grain Marketing work stream (Grades a and b), effective on the expiry date of this Collective Agreement.

The following adjustments will be made to compensation:

1. Effective January 1, 2023, and subject to the terms herein, the Company shall pay a salary increase of 4.5% to all employees covered by this agreement. This increase shall be added to the recipient employees’ rates of pay.

2. Effective January 1, 2024, the Company shall pay an aggregate salary increase to be determined in advance of the annual pay for performance program based on market. This aggregate increase shall be no less than 3.75%. The aggregate salary increase will be payable to employees covered by this agreement and shall be added to the recipient employees rates of pay. The amounts provided to individual employees will be based on each employee’s demonstrated performance for the previous fiscal year and position in their respective salary range.

3. Effective January 1, 2025, the Company shall pay an aggregate salary increase to be determined in advance of the annual pay for performance program based on market. This aggregate increase shall be no less than 2.5%. The aggregate salary increase will be payable to employees covered by this agreement and shall be added to the recipient employees rates of pay. The amounts provided to individual employees will be based on each employee’s demonstrated performance for the previous fiscal year and position in their respective salary range.

4. Effective January 1, 2026, the Company shall pay an aggregate salary increase to be determined in advance of the annual pay for performance program based on market. This aggregate increase shall be no less than 2.5%. The aggregate salary increase will be payable to employees covered by this agreement and shall be added to the recipient employees rates of pay. The amounts provided to individual employees will be based on each employee’s demonstrated performance for the previous fiscal year and position in their respective salary range.

5. Notwithstanding the aggregate salary increases provided for in paragraphs 2, 3 and 4, an employee who receives a “Solid” annual performance review rating (a performance score of 2.5 or more), shall receive a minimum annual salary increase of: 5% effective January 1, 2024; 1.25% effective January 1, 2025; and 1.25% effective January 1, 2026, with the possibility of higher increases based on an employee’s demonstrated performance for the previous fiscal year and position in their respective salary range. If a substantial change is made to the performance scoring system during the term of this agreement, the minimum annual salary increase shall be 50% of the aggregate salary increase.

6. Notwithstanding anything contained in this agreement, the payments referred to under paragraphs 2, 3 and 4 will be distributed to all eligible employees and will be based on demonstrated performance and position in their respective salary range.

Effective dates of merit increases:

Employees eligible for increases for January 1, 2023 will be paid following the signing of a collective agreement that incorporates these terms. The increases will be retroactive to January 1, 2023 but paid only to those employees who were active employees as of December 31, 2023. For all subsequent years during the term of this agreement, merit increases will be paid to eligible employees on or before March 31st (retroactive to January 1st), provided the employee remains active as of March 31st.

An employee is considered “active” if the employee is working or on an approved leave of absence, including a lay off. An employee is no longer “active” if the employee has quit or been terminated. For those on an approved leave of absence: retro pay is payable only on the time worked between January 1 and the date of payment; otherwise, the merit increase becomes effective upon the employee’s return to work.

The only provisions of this Agreement applying to temporary and casual employees are outlined in this Schedule B.

1. Articles 1 to 4, to the extent they are of general application to any employee, regardless of status.

2. A temporary employee as defined in Article 1.3 who is appointed to a Regular Full-Time or Part-Time position as defined in Articles 1.1 and 1.2 shall have his/her seniority recognized from the date the employee was first hired provided that there is no interruption of service.

3. Article 5 – Maintenance of Membership

4. Article 6 – Grievances and Article 7 – Arbitration Board.

5. Temporary employees shall be eligible to participate in the Company’s benefit plan provided their term is initially scheduled to be one year or at the point the term actually exceeds one year.

6. Temporary employees shall be entitled to accrue and use sick leave benefits in accordance with Article 8.2 but only until their accrued sick leave credits are exhausted, while Casual employees are limited to the accrual and use of sick leave as prescribed by the Canada Labour Code.

7. Article 15 – Probation & Termination of Employment.

8. Article 18 – Hours of Work and Overtime.

9. Article 19 – Shift Differential, Call Out and Standby Pay.

10. Article 22 – General Holidays.

11. Temporary employees shall be paid within the range according to their salary grade. Payment above these minimums shall be at the discretion of the Company.

12. All other entitlements will be in accordance with the Canada Labour Code.

Employee Requirements for Sick Leave and Extended Sick Leave

To be approved for Sick Leave or Extended Sick Leave benefits, the following is required:

- An employee is required to notify their manager of their absence with as much advance notice as possible, or at minimum, prior to their scheduled start time. If applicable, they must also notify their manager as soon as they are aware that their absence may continue beyond one calendar week at which time an application form will be provided to the employee.

- Employees must fully participate in the process, which includes timely communication with the Provider (the third-party disability management provider contracted by the Company), their manager and Human Resources, providing the requested documentation by the deadlines outlined, and responding to any other requests made to establish entitlement to benefits.

- Employees’ absences must be supported by medical information provided by the employee’s medical practitioner and approved by the Provider. This information must explain how the illness or injury causes restrictions or lack of ability, such that they are prevented from performing the essential duties of their own occupation. Medical information will not be requested until the 5th consecutive day of sick leave.

- During any period of STD, employees must continuously meet the definition of “Totally Disabled” during the applicable period to receive benefit payments. “Totally Disabled” refers to a degree of restriction or lack of ability due to an illness or injury which prevents employees from performing the essential duties of their own occupation or any modified duties as offered by the Company.

- During any period of STD, employees must be participating in regular, ongoing treatment under the care of a physician, appropriate for their disabling condition during their absence.

Employees are responsible for the costs related to providing medical information. During the STD period, the Company may require employees to submit to a medical, psychological, functional, educational and/or vocational examination or evaluation by an examiner selected by the Provider.

The above-mentioned requirements must be met in a timely manner or sick leave/extended sick leave benefit payments may be suspended. In such cases, the employee may be required to return to work immediately, or, in limited circumstances and upon request, an employee may be eligible for an unpaid leave of absence until sufficient medical information is submitted to support the absence. Employees on an unpaid leave of absence are required to pay the full cost of their benefit premiums. Failure to comply with these requirements could result in an unauthorized leave of absence which may result in termination of employment.

Sick leave/extended sick leave benefits may be preapproved without medical evidence to ensure uninterrupted pay for employees. In the event an employee’s claim is assessed and the employee does not meet the definition of totally disabled, the employee’s claim will be denied and the Company will collect any sick leave/extended sick leave benefits paid that the employee was not entitled to receive.

Payment of Benefits

The Sick Leave Program is self-insured by the Company. This means that the Company will continue to pay all or a portion of an eligible employee’s regular earnings during an approved period of sick leave or extended sick leave. In any event, the Company has the right to make the final decision, in its sole and unrestricted discretion, on the approval of sick leave or extended sick leave benefits and the duration of payment for that claim.

There is a waiting period of one calendar week that may be all or partially covered by any sick leave hours available to the employee. If accrued sick leave hours are not sufficient to cover the waiting period, the employee may be granted a leave of absence with pay (e.g., vacation or other paid leave where applicable) or without pay.

Sick leave payments are a continuation of regular earnings and are subject to standard deductions for income tax, Canada Pension Plan, Employment Insurance, benefit premiums, etc.

Exclusions

Sick leave and extended sick leave benefits will not be paid in the following circumstances:

- During a temporary layoff or other unpaid leave of absence, except maternity and parental leaves, where legislated, when the date of disability is after commencement of such leave.

- Should an illness or injury occur when an employee: has been involved in an illegal activity for which they have been charged and convicted; while operating a motor vehicle under the influence of any intoxicant, including alcohol; has committed or attempted to commit an assault or criminal offence; or has been incarcerated in a prison, correctional facility, or mental institution, by order of authority of a criminal court.

- During a leave for solely cosmetic procedures or medical or surgical care which is not medically necessary. If complications result from these procedures and corrective surgery is medically necessary, such leave would be considered eligible.

- After the date on which benefits have been paid up to the maximum benefit duration.

- For absences due to self-inflicted injuries, unless medical evidence establishes that the injuries are related to a mental illness.

- An illness or injury that is covered by any workers’ compensation legislation.

Limitations

Employees are required to apply for the following coverage if reasonably applicable, and benefit payments will be reduced by any disability and retirement income that an employee receives from:

- Any provincial motor vehicle plan.

- Another group insurance policy.

- A retirement income plan providing income that becomes payable once the employee is no longer actively at work.

- Canada Pension Plan, excluding dependent benefits.

Subrogation

Employees may have alternative first payer coverage in the event of illness or injury. In such a case, employees will be required to sign a subrogation agreement in the event they choose to apply for sick leave and extended sick leave benefits and provide any amounts received from the alternative coverage to the Company. If employees sign the subrogation agreement and are approved for benefits, the Company will provide such benefits. The Company’s sick leave and extended sick leave benefits are considered first payer over Employment Insurance benefits.

Recurring Illness

If an employee returns to active regular duties and full hours but then subsequently becomes ill due to the same or related causes within three (3) weeks of returning to work, the absence will be considered a recurrence and continuation of the first sick leave claim. Benefits will be provided until the maximum duration of one hundred and nineteen (119) calendar days has been reached.

If an employee returns to active regular duties and full hours for a minimum of one (1) day and subsequently becomes ill with a condition that is unrelated to the cause of their first sick leave, the subsequent illness will be considered a new disability and they will be eligible for a new period of Sick Leave and Extended Sick Leave benefits.

Appeals

If an employee’s application for sick leave or extended sick leave benefits is declined and they wish to appeal, the following timelines apply:

- Intent to appeal must be submitted to the Provider within fourteen (14) calendar days from the date of the letter of decline.

- New medical information must be submitted to the Provider within thirty (30) calendar days from the date of the letter of decline.

A sick leave or extended sick leave claim decision may be appealed a maximum of two (2) times. The Provider will give employees written notice of related deadlines and instructions for the appeal process.

Other Procedures

Employees who have had several multi-day absences or have a history of frequent absences which may result from a medical condition may be referred to the Provider. The Provider will review and determine whether there is a medical condition impacting the employee’s ability to attend work on a regular basis and to provide assistance and support in improving attendance with or without accommodation.

All sick leave absences (including single day absences) must be recorded and approved through applicable time recording procedures.

LETTER OF UNDERSTANDING

RE: Change to Salary Range Minimums and Maximums During Term of Collective Agreement

In the event that the Company conducts a market review of salaries prior to the expiry of the Collective Agreement, the Company may amend the Salary Range minimums and maximums, as referenced in Schedule A of this Collective Agreement, subject to the following terms and conditions:

(i) Any amendments to the Salary Range minimums and maximums shall be increases only, not decreases, although it is understood that the minimums and maximums of some Salary Grades will remain the same.

(ii) The Company shall notify the Union of its intention to amend the Salary Range minimums and maximums by February 1 of the year in which the amendment will become effective. At the same time as providing that notice, the Company will provide the Union with the proposed new Scale of Wages/Salaries including the market zone that has been determined for each Grade that is subject to a Salary Range adjustment.

(iii) To align with the terms of Article 25 and Schedule A, the effective date of the amended Salary Range minimums and maximums in the Scale of Wages/Salaries will be January 1 of the year in which they are amended, in order to coincide with the annual merit pay process for January 1. Merit pay increases will be determined in the context of the amended Salary Ranges and any compensation adjustments that are necessary to comply with the amended Salary Range minimums and maximums will be made as part of the merit pay process.

This Letter of Understanding will remain in effect until the parties complete negotiations for a renewal of the current Collective Bargaining Agreement.